Muskoka Lakes waterfront real estate has completed a major transition – so let’s zoom out and look at the 2025 Muskoka Lakes waterfront real estate market in the context of recent years. Over the last three years, we’ve moved away from the chaotic, high-speed frenzy of the pandemic era and into a much more selective, strategy-driven market.

If you look only at higher inventory and longer selling times, you might see “softness.” In reality, this is a sign of maturity. Buyers are no longer rushed; they are deliberate. Pricing is less erratic, and outcomes depend heavily on how well a property is positioned and prepared.

The market in a sentence: Well-presented, accurately priced properties are selling well – but with more choices available, strategic execution is now the difference between a quick sale and a year on the market.

Executive Summary: Patience, Precision, and the Return of Seasonality

The waterfront market across the ‘Big Three’ – including Lake Muskoka and Lake Rosseau – is behaving like a true luxury market again: seasonal, data-driven, and selective. Properties that are priced for today and presented properly can still sell efficiently. Properties that lean on peak-market nostalgia or have avoidable friction are far more likely to linger.

Part 1: The Three-Year Story (2023-2025 YTD)

To understand where the market is going, we need to look at where it’s been. Here is the three-year journey, broken down by year. All 2025 data is Year-to-Date (Jan–Nov).

2023: The Great Normalization

2023 was the first full year where things settled down. Sales volume returned to recognizable seasonal norms, with activity concentrated in spring and summer months. Prices remained high, but the era of massive price escalation was over – replaced by a market seeking structural balance.

2024: The Year of Friction and External Shocks

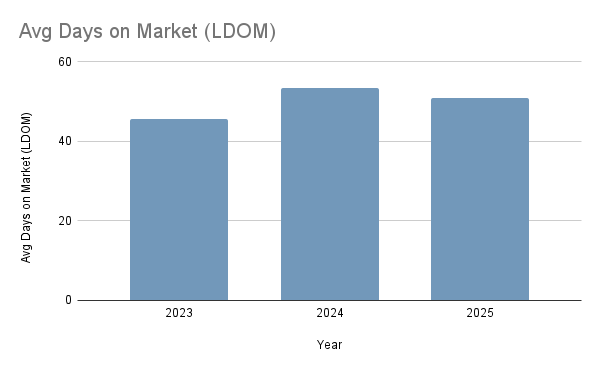

2024 revealed the full character of the “new normal,” showing increased patience among buyers, lower transaction volume, and higher Days on Market (DOM).

The Macro-Driver: Bank of Canada Rates

The primary force shaping this selective market was the high interest rate environment set by the Bank of Canada. While many Muskoka buyers are equity-rich, high borrowing costs slow the pace of discretionary decisions and increase buyer scrutiny. Sellers could no longer rely on market velocity alone.

The Specific Shock: Capital Gains Pause

A distinct anomaly occurred mid-year: the Federal capital gains inclusion rate change (announced in the spring) caused a visible “pause” in buyer activity around the June 25th deadline. This policy change caused sales volume to drop sharply in July before the market restabilized – proving external policy now matters as much as local demand.

2025 YTD: Volume Rebounds, Selectivity Remains

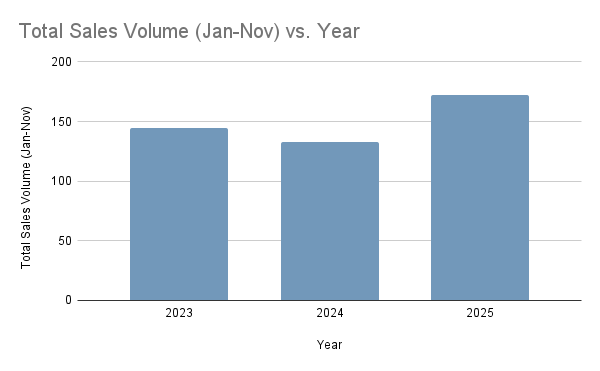

On a volume basis (Jan–Nov), 2025 clearly outpaced both 2024 and 2023. The market proved it has the depth of demand to absorb serious inventory.

Key Insight: The May 2025 Supply Shock

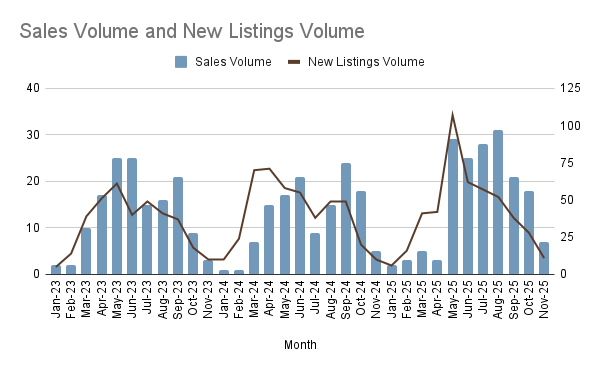

In May 2025, we saw a record 107 new listings enter the Muskoka Lakes market in a single month – a massive wall of supply. The fact that the market successfully absorbed this volume proves that when demand aligns with value, the market is robust. However, this rebound was highly selective and concentrated between June and August.

Our Muskoka Lakes Waterfront Real Estate Market Report 2025 confirms a clear year-over-year sales volume rebound.

A significant May supply shock: Analyzing how the 2025 Muskoka waterfront market absorbed record-high listings (Sales Volume measured on the Left Axis, New Listings Volume on the Right Axis).

Part 2: Decoding Muskoka’s Market Rhythms

Muskoka is not your primary-residence market. Two factors are always at play: Seasonality and Selectivity.

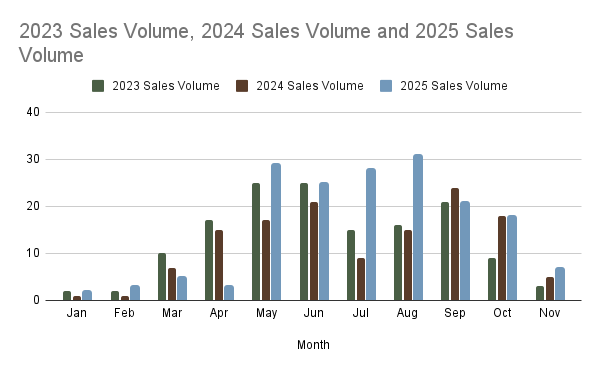

1) The Dominance of Seasonality

Muskoka’s market runs on a simple calendar: most listings and sales occur between April and October.

- Peak Season (Late Spring/Summer): The core operating window. The market is healthiest, absorption is strongest, and pace is quickest.

- Off-Season (Winter): Winter data often reflects homes that didn’t sell in summer and are now dormant. Metrics like DOM and MOI can look extreme, but they reflect low activity more than true leverage. Never base a key decision on winter market data.

Historical Sales Trends: Why the late spring and summer months dictate market success.

2) The Power of Selectivity

Today’s luxury buyer is armed with data and is willing to wait. This has shifted the advantage to listings that are flawless in presentation and pricing.

What Sells: Listings with clean access, strong staging, professional photography, and clear value relative to recent sales.

What Lingers: Properties with limiting factors (boat access only, steep terrain, dated interiors) or those priced based on nostalgic peak-market highs.

This selectivity means the market’s average price is often just a reflection of which properties sold that month, rather than a broad movement in value. A few ultra-luxury sales can skew the average dramatically without changing the value of the home next door.

Part 3: What the Key Metrics Reveal

Here’s what the market metrics are telling us in plain English:

| Metric | What It Measures | What We’re Seeing (2025 YTD) | Strategic Takeaway |

|---|---|---|---|

| DOM (Days on Market) | How long it takes to sell | Moderated to a more active 46 days on average | If you price correctly, a sale can happen quickly – but buyers still take their time |

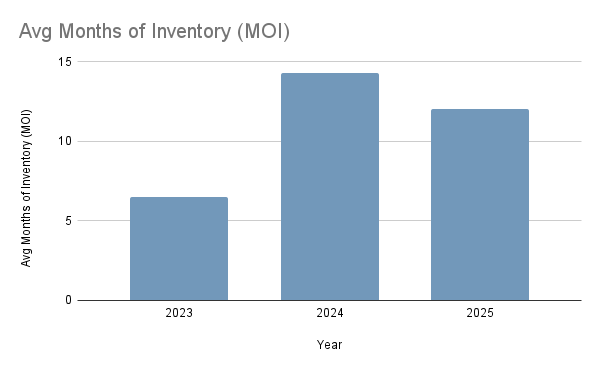

| MOI (Months of Inventory) | How much choice buyers have | High overall, but healthier in peak season (closer to 6-7 months in summer) | Buyers have plenty of choice. Sellers must stand out, especially outside the summer window |

| SP/LP (Sale-to-List Price Ratio) | How close sellers get to asking price | Held relatively firm at 95.1% | Sellers who price realistically are maintaining discipline and avoiding large price cuts |

Buyer patience peaked in 2024, confirming that the Muskoka Lakes waterfront real estate market rewards strategic pricing over market speed.

Increased inventory levels across the Muskoka Lakes waterfront market continue to provide buyers with significant selection and leverage.

Part 4: Strategic Outlook for 2026: Preparation, Patience, and Precision

The Muskoka Lakes waterfront market is not crashing; it is maturing. 2026 is set to reward preparation, patience, and precision. It will not reward nostalgia or passive strategies.

Actionable Advice for Sellers

- Price for Today, Not Peak-Market Memory. Anchoring your price to 2021/2022 highs is the single biggest cause of friction.

- Time Your Launch Strategically. The strongest absorption consistently aligns with the May/June launch window. Don’t launch too early and waste your best time on market.

- Presentation is Non-Negotiable. In a selective market, staging, professional photography, and a clean narrative are paramount.

Actionable Advice for Buyers

- You Have Leverage in Time, Not Guaranteed Discounts. You have more time and selection than in previous years, but don’t assume every listing is deeply negotiable.

- Act Decisively on Quality. Truly well-positioned listings with strong value are still capable of moving quickly, even in a selective market. Don’t wait on an A-list property expecting it to linger.

Connect with Your Muskoka Waterfront Expert

The data confirms that success in today’s Muskoka Lakes market hinges on micro-strategy and local expertise. The difference between a six-month listing and a swift, profitable sale is no longer luck – it’s expert preparation and timing.

For sellers seeking to position their luxury property for peak value, or for buyers looking to navigate the selectivity of this new environment, working with a specialist is essential.

Catharine specializes exclusively in Muskoka, Ontario waterfront real estate. She provides the data-driven insights and strategic counsel required to succeed in this maturing luxury market.

Frequently Asked Questions (FAQ)

What is the current state of the Muskoka Lakes waterfront real estate market in 2025?

The 2025 market is defined by maturity and selectivity. While sales volume rebounded significantly year-over-year, buyers are more deliberate. Success is now determined by expert pricing and property presentation, not market speed.

Is the Muskoka waterfront market experiencing a crash or a price correction?

The data suggests the market is maturing and normalizing, not crashing. Sellers who price realistically are maintaining discipline (Sale-to-List Price Ratio held firm at 95.1%), while increased inventory gives buyers more selection.

What is the best time of year to list a luxury cottage in Muskoka?

The market is dominated by seasonality. The strongest absorption and quickest pace consistently align with the Peak Season window, typically from late May through August. Strategic launch timing is critical to maximize value.

Leave a Reply